Case Study: Academy Football of Australia

“Latpay’s payments solutions streamlined our event operations, more than we what expected. Their responsiveness, expertise and willingness to deliver a solution that met our needs was second to none. With an easy-to-use interface and pre-event training our staff we’re equipped to transact with customers without any interruption.” Taryn Event Coordinator

Problem

With less than two weeks until our on-site event at Kokoda, we needed a fast, local and convenient solution to facilitate onsite payments and ease of reconciliation. No previous payment infrastructure was in place, our staff were inexperienced, and this was the first year we were participating in Kokoda, it was all new to us.

We had over 45 volunteers lined up for the two-day event, who would all be working remotely at various stations and would be regularly switching in and out as their shifts start and end.

We needed this event to be successful so that our fundraising efforts for the 80+ boys and girls who train at our club could go on an exclusive training field trip to New Zealand.

Solution

Through a discovery consultation with Latpay, they were able to pinpoint our exact transactional and reconciliation requirements. They also identified requirements of ours, we didn’t even know we needed.

Their responsiveness and expertise equipped our workforce with hire solutions of:

- 5 Terminal Devices

- 5 Power Banks

- 5 Mobile Devices (set up and all ready to go)

They had our account set up, verified and ready for payments in just a matter of days. Pre-event training was provided to our team and event onsite support.

For ease of reconciling Latpay separated our reconciliation into two separate accounts:

01 – Account > For regular membership

02 – Account > Kokoda Parking / Fundraising

This meant that we had full transparency without any manual reporting or intervention to know how much funds have been generated at this event, but also for any future events with our secondary account (02) able to be swapped out p/event.

Outcome

On Friday 17th July, we launched our inaugural Fundraising Event at Kokoda. With our 48 volunteers across the two days, we seamlessly transacted with customers at our sausage sizzle, paid car park and at our stall. With pre-event training, all devices configured, and equipment solutions made available for hire, Latpay equipped us with everything that we needed for the event to be successful.

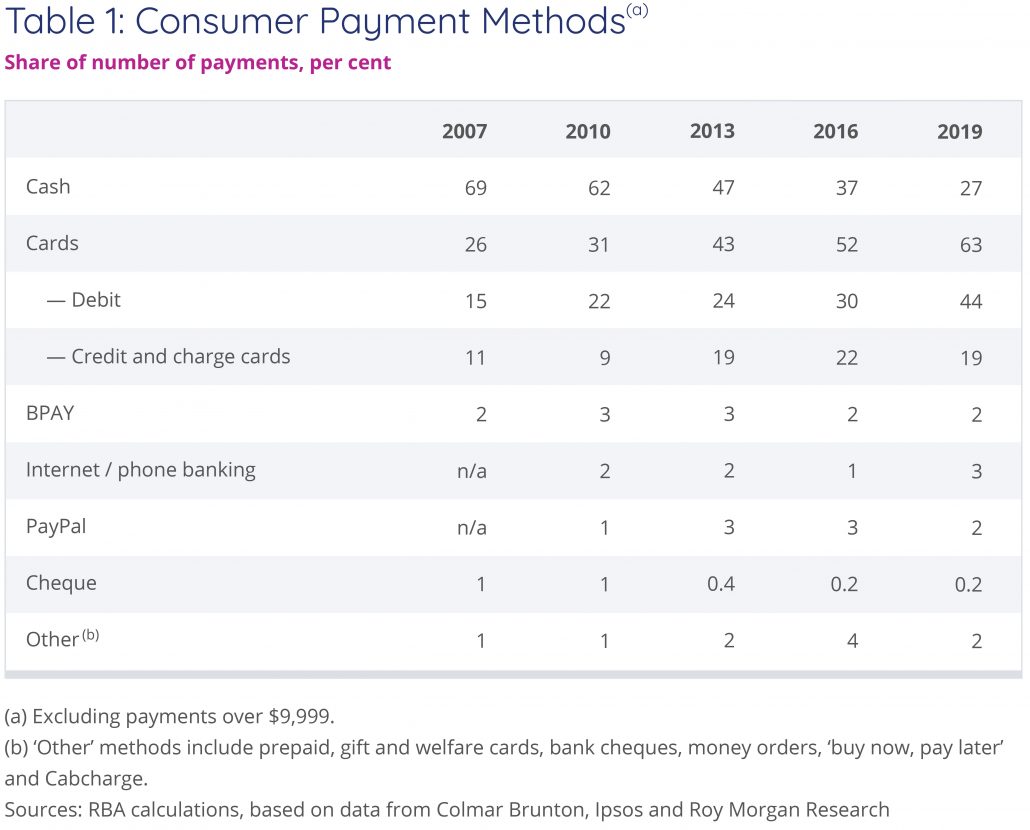

We were one of the only vendors at Kokoda able to accept card payments. This was a huge benefit for our customers who didn’t always have cash available.

Transitioning between volunteers shifts, was easy and seamless with minimal time spent setting up new volunteers.

We have also found that with the flexibility to add an accurate transaction description, from the addition of a secondary account, we have had significantly fewer chargebacks and disputed transactions than our everyday operations.

Latpay is working on a solution to accept smartpayments (digital wallets) which will only benefit their terminal devices as well as being able to accept eftpos transactions.

Find out how Latpay’s customisable payment solutions can support your club, association and organisation. Make an enquiry today!