INNOVATION IN PAYMENTS FOR OVER 17 YEARS

We have been processing payments for large and small businesses around the world since 2001. The knowledge and experience we have gained in the payment industry has been incorporated into our payment systems and business processes to benefit our global client base.

We are an independent company and privately owned; in fact, the original founders of Latpay are very involved on a day-to-day basis, which makes decision making very efficient.

PAYMENT HUB

All services, all in one place.

Omni-channel, single platform, multiple payment methods.

Multi-currency, process in over 150 currencies.

LEARN MORE

BESPOKE

Every business is unique, not one size fits all.

We tailor a package to suit you.

Complete payment services with built-in flexibility and scalability.

We build relationships, not contracts.

LEARN MORE

B2B SYSTEMS

Billing systems and solutions.

Technology partners.

Independent, flexible, robust.

LEARN MORE

OMNI-CHANNEL

Online, mobile pay, mPos, Virtual Terminal.

A single, simple integration.

90+ acquirers, 30+ alternative payment suppliers.

LEARN MORE

SMART PAYMENT SWITCH

Providing local payments to your global customer base.

Channel payments to multiple banks and payment providers.

Increase acceptance rates on local and international business.

LEARN MORE

MOBILE PAYMENT TECHNOLOGY

Mobile POS (mPos).

Point-of-sale integrated to mobile platform.

QR Code and mobile payments.

LEARN MORE

DEDICATED DEVELOPMENT TEAM

Innovation in technology for 17 years.

Professional, experienced, committed.

Any new technology, anywhere, anytime!

LEARN MORE

TOKENISATION – TOKEN VAULT

Easy, one-click payments for customers.

Tokenisation Beyond Payments.

Encrypted, secure Level 1 PCI DSS compliance.

LEARN MORE

GIVE YOUR BUSINESS A COMPETITIVE EDGE, WITH ALL THE SERVICES ALL IN ONE PLACE

Latpay is built on modern architecture, reliable at processing large volumes with appropriate security, access control and audit trails. Latpay is a true payment hub!

From multiple sales channels and devices, you can access over 90+ global banks and 30+ alternative payment methods, processing in over 150 currencies with settlements in 26 currencies.

Latpay’s in-depth knowledge of the international payments arena puts you in the driving seat, helping you realise your global ambitions.

Through a single integration into our systems, we allow you to seamlessly cross borders, giving your customers the opportunity to pay using their local payment method. Not only does this drive revenue through increased conversions at the point of checkout, but it will instantly improve your customer service credentials.

Our suite of services has been perfected and enhanced over the years, so you can reach customers locally and globally with one simple integration.

Latpay’s multi-currency, secure payment gateway, gives you connectivity to:

- Local merchant facility and direct debit/direct credit facility.

- 90+ acquiring banks.

- 30+ alternative payment methods.

- Real-time transaction data, statistics and reports – all found in one secure location.

Features and functionality:

- Users can access real-time reporting and transaction management tools to process refunds.

- We provide bespoke statistics, billing and reconciliation reports that are easy to use and decipher, and gives you full control of your revenue stream.

- Available balances across all payment methods and currencies.

- The ability to search, view and manage your transactions, refund or cancel them.

- Manage your recurring direct debits and direct credits payments.

- Manage your batch payments e.g. staff monthly payroll.

- View daily statistics at a merchant group level, company level and customer level.

- Create your own specific reports – we will build them for you.

- View and download reconciliations, charge-back reports, billing statements, daily balance and payout reports.

SECURE, FLEXIBLE & INDEPENDENT

Businesses with multiple outlets, agents or franchises, can create “merchant group” accounts and have many linked accounts to make your accounting, settlements and reconciliations easier to manage.

With the sophisticated levels of user access on a merchant group level, or per account level, you can access real-time reporting, transaction statistics and reports that are easy to decipher, giving you full control of your revenue stream.

In our 17 years of trading, Latpay has built many successful business relationships and partnerships. We partner with companies in different countries and have successfully built systems that integrate into local payment platforms, payment methods and billing systems. Building partnerships have given us access to many new markets and payment methods that we can provide to our clients. LEARN MORE

MANAGE YOUR PAYMENT FLOW, INCREASE ACCEPTANCE RATES

APPLY NOW

Most importantly, centralising your payments makes achieving higher acceptances rates easy. Integration into our payment hub is straight forward, we’ll manage all the technical connections and relationships with the networks, banks and payment providers on your behalf.

If you have your own Merchant Account you can still take full advantage of our sophisticated Smart Bank Switch.

Our payment hub provides secure and certified connectivity to 90+ acquiring banks and 30+ alternative payment providers in over 40 countries.

Implementing a local acquiring strategy gives you access to new markets. By having more insight into local markets and local payment methods, it immediately puts businesses on a competitive equal footing with local and regional companies.

Using our Smart Bank Switch – you can control the payment flow, providing local payments to your global customer base.

Simply put, its allowing local businesses to CROSS BORDERS and control the payment methods offered to local customers in those target markets.

Its about having a truly global payment solution.

For example: An Australian company sells online to customers in the Netherlands. By using our Smart Switch, the Netherlands customer will checkout on the Australian website, and pay in their local payment methods, such as: Sofort, GiroPay, ELV, as well as having the Visa and MasterCard options. The Australian company will receive their funds in Australian Dollars.

Keeping ahead of fast-paced technology – we love the challenge!

Dedication is an understatement. Connecting with Latpay will provide the agility and innovation you need to keep ahead of the pace.

We all believe that customers should come first and that good customer service is mandatory.

We see our clients as business partners – people and companies that we want to build long term relationships with. We strive to provide exceptional customer service because our customers are at the heart of our business and together we can grow!

CUSTOMISED PAYMENT SOLUTIONS FOR BUSINESSES AROUND THE WORLD

Every business is unique, not one size fits all.

Our robust system allows for technical changes to accommodate bigger or less flexible systems. We do this as an affordable alternative to re-inventing technology that we have already built. Our dedicated, very professional technical team are always on hand to help get you up and running and accepting payments sooner!

We are always available to discuss your needs and help your business grow. Give us a call on 1800 865 224.

ACCEPT ANY AND ALL PAYMENTS THROUGH A SINGLE HUB

One simple integration that gives you access to our sophisticated, bespoke suite of services with a range of local and global payment methods, giving you a truly global reach.

1. SALES CHANNELS

Give your customers the choice to pay in a way that’s familiar to them, whether it be in person, online or via a mobile device. Access a sophisticated payment gateway and reach customers locally and internationally through one simple integration. LEARN MORE

2. LATPAY PROCESSING

Our PCI compliant, multi-currency gateway can process high volume payments through omni-channels in real-time. Using our intelligent bank switch, Latpay provide industry-leading security with secure processing, tokenisation, access control and audit trails. LEARN MORE

3. PAYMENT NETWORK

Access 90+ local and global payment methods, processing real-time payments via our secure, multi-currency payment platform. State-of-the-art SSL encryption technology ensures data transmission is always secure above and beyond industry standards and in line with our PCI Certification. LEARN MORE

Give your customers the choice to pay in a way that’s familiar to them

- 90+ local and global acquiring banks and 30+ alternative payment methods.

- One single integration accesses all payment methods, giving you a “truly global” reach.

- 150+ processing currencies and 26 settlement currencies.

- We can set up your merchant facilities.

MOBILE SOLUTIONS FOR ANY BUSINESS, ANYWHERE

Just scan your customers card and the payment will follow the same rigorous controls and authentication protocols as our tried and tested e-Commerce transactions. In fact, the transactions will pass through the same Latpay hub as a “card not present” transaction.

The same merchant facility can be used for your online website transactions and your mPos payments. All transactions are viewed in our real-time reports.

Alternative payments through mobile. Why not add multiple payment methods for your customers? Through a single integration, you can offer multiple payment methods. Point of Sale (POS) systems and standard payment terminals in physical retail shops are sometimes inflexible. Latpay is constantly working on adding POS software to our payment hub to improve your customer reach and to offer multiple payment methods on your mPos.

Using QR Codes to process payments is a secure and easy way for your customers to transact with you.

MPOS

SMS MARKETING

MOBILE PAYMENTS

SMS PAYMENTS

QR CODE PAYMENTS

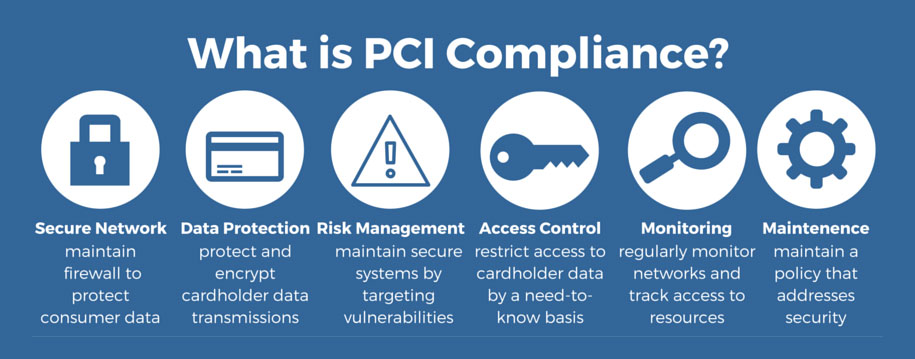

SECURITY IS PARAMOUNT

Many large and small businesses face increasing challenges within the payment sphere, not least in the area of PCI compliance and specifically in the management and the storing of sensitive card data. Recent high profile security breaches have reinforced the view that failure to have the correct systems in place can have disastrous consequences for any e-Commerce business.

By using Latpay, you could mitigate many of the most difficult PCI compliance issues through a system called tokenisation, which can be easily and affordably integrated into your custom built payment page and existing API transaction flows. All your sensitive payment data is encrypted using a randomly generated, totally unique ID number or ‘token’. The token will give you access to your customer records, to search, view or even export your data for accounting and management purposes.