COVID Update: Rise in cashless payments amid coronavirus

Are you opting for cashless payments in light of COVID-19?

Since the beginning of the coronavirus outbreak, concerns have circulated about the possible hygiene implications of handling cash.

While it may not be the main mode of transmission, it is suggested that COVID-19 may stick to surfaces for hours and even days. This means that touching your mouth, nose or eyes after handling cash could potentially encourage the virus to spread.

Regardless of whether these concerns are founded or not, the notion that cash could be a carrier for the disease has seen both consumers and businesses alike alter the way they choose to operate.

Health concerns about cash payments

The potential for coins and banknotes to house bacteria has been acknowledged for many years yet largely unacted upon. However, this seems to be changing rapidly due to the unfolding pandemic and serious risks associated with the COVID disease.

With these concerns circling the media and propelling public concern, many businesses are now opting for cashless payments.

Cashless payments

The increasing push away from cash has ultimately pulled consumers towards cashless payments like Eftpos and Tap and Pay.

This presents an opportunity for businesses to enhance their electronic payment methods in order to accommodate consumer preferences.

And while COVID-19 has seen many shy away from cash, this move has actually been in motion for many years.

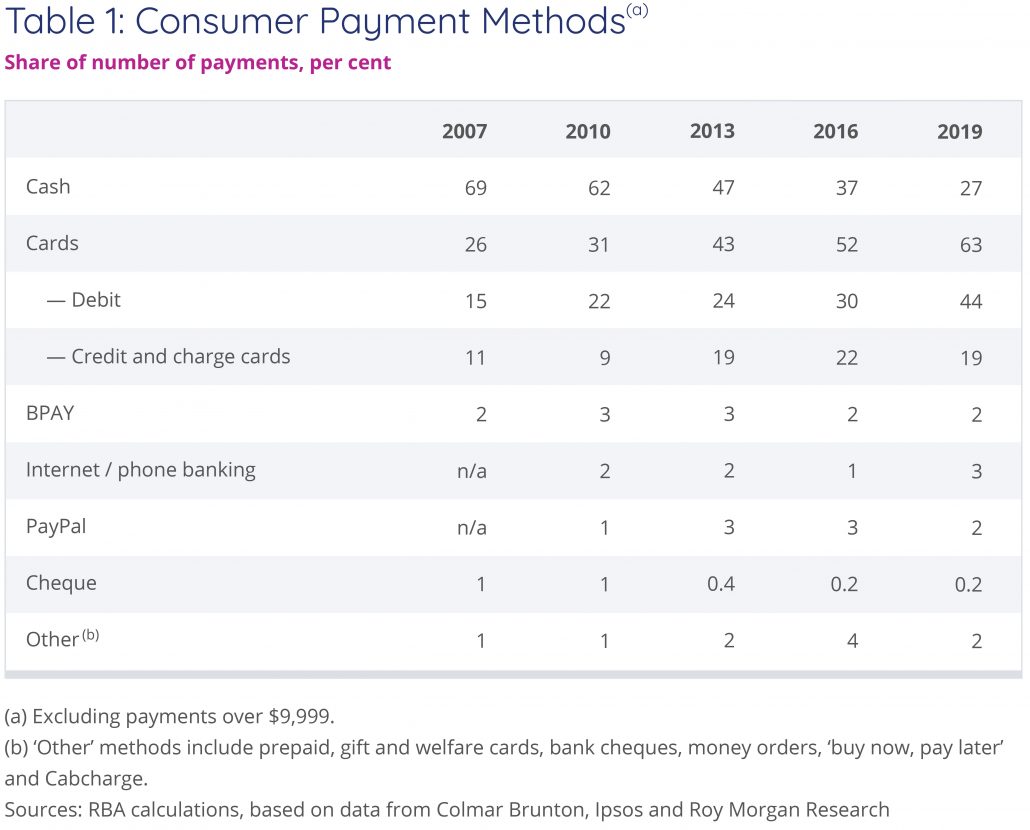

Whether for convenience, security, hygiene or other factors, payment via debit card in Australia has almost tripled since 2007, while cash payments have more than halved in the same period.

Of course, some people are adopting this technology far more quickly than others, with late adopters generally being older Australians and those with lower socioeconomic backgrounds.

Despite this, the shift towards a cashless society is clear; COVID-19 has exacerbated (not instigated) the preference for cashless payments.

Source: Consumer Payment Behaviour in Australia | Bulletin – March Quarter 2020

Other benefits of cashless payments

Aside from the hygiene factors present in the current COVID-19 climate, there is a range of other great benefits to using contactless payment methods for business. Some of these include:

- Ability to take more payments in less time

- Reduced possibility of unbalanced cash floats

- Reduced security risks & potential for theft

- Ability to action refunds and discounts more easily

- Understand your customers better with reporting and analytics on all transactions

Coronavirus update: Business as usual at Latpay

In light of the evolving COVID-19 crisis, the team at Latpay are committed to maintaining normal business and payment processing operations over the weeks and months ahead.

Our office is closely monitoring the advice of local governments. We have tried and tested contingency plans ready to implement to ensure there is no change in the level of support we currently offer you across all our teams.

Our plan includes employees having the necessary technology to work remotely, regardless of office location. This course of action not only helps protect the health and welfare of our staff members but also ensures we can continue to deliver the support you need through these challenging times.

If you have any questions or concerns, please don’t hesitate to contact us via phone, email or Skype. And most importantly, stay safe.