Can mCommerce Solve the Conversion Crisis?

Gertjan Dewaele of Ingenico ePayments argues that “mobile shopping has established mCommerce as a key sales channel”

Put your mobile where your commerce is

The vast majority of merchants understand that mobile innovation affects customer satisfaction and profitability, but this awareness needs to be matched by action if they are to make the most of the mobile commerce opportunity. No merchant can afford to ignore the revenue-generating potential of mCommerce.

More than three quarters of UK shoppers use their mobile to make purchases online while commuting or travelling, and 45% browse in their free time. It’s a growing trend. UK consumers now spend twice as much time on their mobile device as they do on a PC or laptop, and the use of mobile apps for shopping is on the rise as well. 83% of time spent on mobile is app-related and more than half of that is spent shopping.

On the other side of the Atlantic, 40% of online purchases in the US were made on mobile devices in 2017, a 29% increase over 2016.

Taking a closer look at Europe’s largest economy, Germany, we can see that mobile commerce has been a slow burner, but consumers have begun using their phones to make online purchases in greater numbers. mCommerce in Germany now accounts for 12% of purchased goods. Ready for a boom, it is estimated that mCommerce volumes will increase by 39% and represent 42% of total retail ecommerce sales in the country by 2021.

Avoid abandonment

In spite of this burgeoning international mobile trend, many merchants are falling behind in trying to meet their customers’ expectations. Research by Ingenico ePayments and InternetRetailing found that only 57% of those active in sectors such as travel and gaming declared having a responsive website for desktop and mobile as their main focus. Just 39% described themselves as being ‘mobile first’.

The negative impact of this lack of innovation in mobile is becoming increasingly clear. Our research has found that 60% of all shopping carts created are abandoned before payment and that one in five consumers do not complete the payment process. The result is a considerable amount of lost revenue for merchants and large numbers of unsatisfied customers.

A smooth customer experience

Fortunately, there are several steps that can be taken to ensure that more of these planned purchases are completed. Investing in a frictionless mobile experience is a good starting point: although just over half of the retailers we surveyed are currently investing in this area, 40% intend to do so over the next two years.

Firstly, merchants should ensure their mobile site is localized, meaning consumers can pay how they like based on where they are in the world.

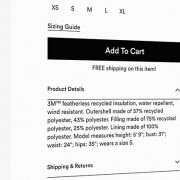

As well as this, they need to be aware of the importance of optimizing the payment page, from using a numeric keypad, to automatically format credit card numbers to detect invalid inputs. Cutting out unnecessary steps in the payment process will improve conversion rates. After some merchants found that 3D Secure was showing a potential to negatively affect their conversion, they utilized it only for high transaction values or enabled tokenization to provide a fast-track experience for returning customers. 3D Secure 2.0 will use advanced data analytics to help determine cases where additional security measures are required, reducing the barriers for the majority of consumers.

Finally, consider the options available. There are payment methods that work better on mobile, such as PayPal and Apple Pay, both of which are helping merchants to shift away from a sluggish system to an omnichannel future, in line with high customer demands.

Next level mCommerce

Of course, now that mobile is becoming mainstream, it doesn’t mean the environment stops evolving. Innovations are always on the horizon to stay relevant to consumers.

Already there is a new sales channel for consumers which is ideal for the mobile device: chatbots. This tool is seeing great success with Generation Z and millennials, yet just 16% of the internet retailers we surveyed were investing in messaging bots for conversational commerce. Seeing more consumers turn to this sales device is certainly likely, though, as more than half of those surveyed plan to enlist it within the next two years.

We expect this to soon become commonplace. With the first pilot results, we’ve seen a six-fold boost in conversion while using chatbots versus a mobile website. These bots learn patterns of behavior and can target customers, offering the products or services that would be of most interest – a level of personalization that leads to better conversion rates and higher customer satisfaction.

Another – often overlooked – avenue for conversion is the moment after the purchase. Following the transaction, a merchant can leverage this time to entice customers to purchase additional items or encourage their return. Providing a related product (insurance, for example) or offering smart discounts via gamification will maximize the conversion on the initial transaction and help create a loyal consumer base.

The future is within our grasp

We aren’t losing the in-store experience just yet, though. In fact, mobile may be the key to revitalizing a practice that has fought a losing battle in recent years. We’re seeing a number of ‘scan and pay’ projects creeping into the market, which are using mobile devices to drive a better in-store user experience – and boost completed transactions in the process.

It’s clear that the sheer convenience of mobile shopping has established mCommerce as a key sales channel, which means that merchants have to optimize their mobile site and payment processes in order to be in the sales game.

Source: The Paypers – http://bit.ly/2C7xDJe